By: Faizan Haq, Editor-in-Chief & Publisher, Your Bliss Magazine

Getting closer to the end of the year, days are very precious. Getting ready for holidays, buying gifts for loved ones, and making travel plans are just some of the examples of activities that fill our end-of-the-year months and days. Many plan to be away from their businesses and jobs during the holidays. However, in business, the end of the year mounds extra responsibilities. It must plan for end-of-the-year bonuses, incentives, and end-of-the-year gatherings for business employees and stakeholders.

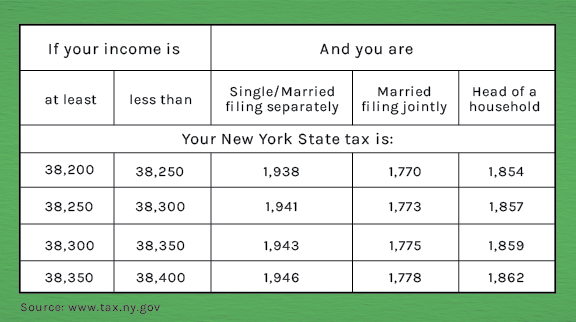

The most important responsibility to remember for a business, no matter what the quality of its relationship, is taxes due to the federal and state governments. You must make sure you have made arrangements to pay your dues to these entities and plan for the entire year. For retirements, 401ks, and other pension plans, there is still some flexibility until April 15th of the next year, however, the planning and budgeting must be done now.

If you plan for this exercise before the end of the year, it will help you to remain financially healthy and embrace the new year with less stress. Many entrepreneurs choose not to take any time off at the end of the year but plan their vacations after the first of the new year. It helps them to focus on planning for the next year and avoiding financial stress before the next taxes are due. Business is a lot like a human body it requires healthy nourishment, exercise, and good stress management. The team that is involved in governing the business must understand that the more undue stresses your organization goes through, the weaker it gets. The financial tensions in a business are due to unwise decision-making and erroneous planning. The effect of such ill decisions and bad business habits does not hit you right away. It takes business cycles for them to confront you. One must always prepare for these cyclical ups and downs that one’s business must face. The best strategy is to plan ahead of time. Be well-informed about the industry of your business and surround yourself with good and experienced advisors. The company matters a lot.